Service Profit Chain defines and manages the relationships between employee satisfaction, loyalty, productivity and value add which drives customer satisfaction and loyalty, leading in turn to improved and sustainable profitability. The reality is that it isn’t good enough to just satisfy customers to achieve long-term success. Ideally, organisations need to develop loyal customers, who will not only keep delivering repeat business but will recommend your business to family and friends. Such loyal customers are often referred to as “promoters”.

It would be a mistake to think about the Service Profit Chain as only relating to services businesses, such as airlines, banks, hotels etc, although it is in that context the book of the same name was originally written. The reality is that every business has customers and delivers customer service every day in one way or another. Even online businesses. Every one of us has customers, all be it often internal customers who serve external customers and need the confidence of knowing their colleagues and the organisation they represent are there supporting them.

Developing Loyal Customers

A basic principle of the Service Profit Chain is that customer satisfaction and ultimately loyalty depend upon satisfied and loyal employees. In simple terms, loyal employees add value to customer interactions or at what Jan Carlzon refers to as “Moments of Truth” in his book of that name. During moments of truth, loyal employees add value to the customer and convey their enthusiasm about the organisation they work for. Customer satisfaction and loyalty are predictive rather than retrospective indicators of business performance. We talk in more detail about this on our Service Excellence and Customer Loyalty page.

Developing Loyal Employees

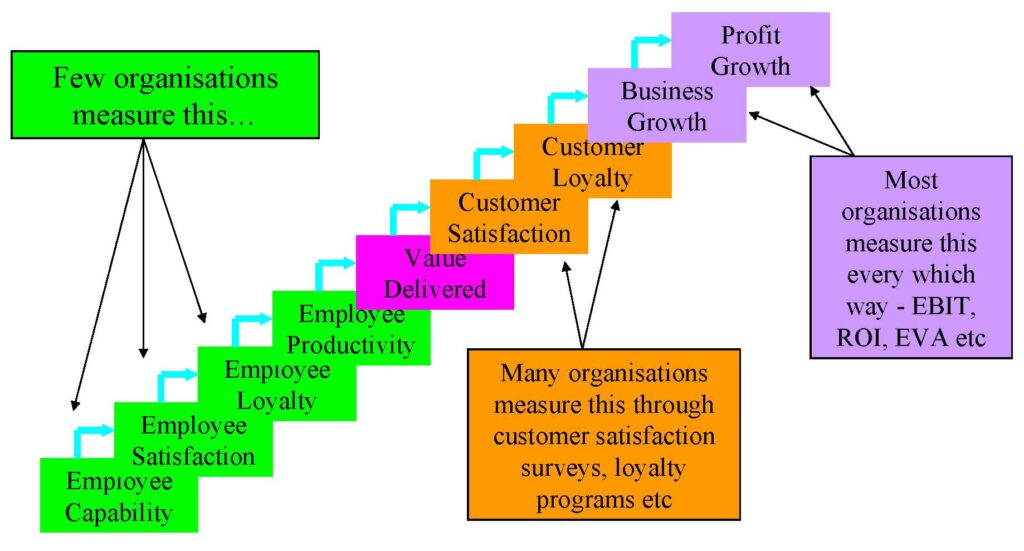

Businesses derive very clear and quantifiable benefits from loyal employees. Including higher retention rates, lower absenteeism, improved culture and a greater focus on customers. Yet amazingly few employers measure employee satisfaction or loyalty which can also be considered as predictive rather than retrospective indicators of business performance. Whilst everyone likes to be paid well, the reality is that many other factors go into developing loyal employees. It is also worth noting that few employers regularly measure employee capabilities, by which we don’t just mean personal skills, training and capabilities but the systems, processes and procedures that employees are required to use to deliver products and services to customers. If these make it hard for an employee to do their job and satisfy customers then the loyalty of both will become questionable. We talk more about this on our Employee Management and Loyalty and Process and Productivity pages.

Past Performance is Not an Indicator of Future Performance

The great majority of businesses measure financial performance in one way or another. Financial indicators are retrospective indications. That is, they measure what happened in the previous reporting periods. As those ads for Australian Superannuation Funds often say “Past Performance is Not an Indicator of Future Performance.” In other words, managing a business using only financial indicators is like driving a car using only the rear vision mirror. Businesses wanting to achieve ongoing success need to consider both retrospective and prospective performance indicators. We talk more about this on our Organisational Performance Management page.